Tangible fixed assets

Understand depreciation

Unit 12

Tangible fixed assets are usually recorded in an assets ledger, where details of cost, revaluations,

cumulative depreciation and net book value are maintained on an asset by asset basis.

Summaries by groups of asset type are also usually available.

The new asset is on the asset side of the accounting equation and is debited to fixed assets.

The other entry of the double entry is to either reduce the bank account (with an immediate payment)

or create an accounts payable liability, in either case a credit entry.

As an example the enterprise buys a new computer for £1,000 initially on credit terms.

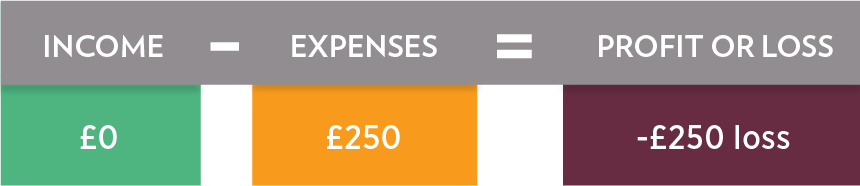

Depreciation of a asset usually starts when the asset is first brought into use by the enterprise. The impact of depreciation is to reduce the value of the asset; so the asset side of the accounting equation is credited with the depreciation amount and the profit (Owners Capital) is reduced by the same amount, or debited.So for example if depreciation in the first period is £250, then (assuming the supplier has still not been paid) the equations would be:

An asset ledger should usually provide the necessary features to

- Add an Asset to the ledger, giving the details to allow the system to calculate depreciation

- Post depreciation to the appropriate accounts automatically

- Buy an asset, dealing with the practical aspects of making the purchase from a supplier

- Selling an asset when the enterprise no longer needs it

- Revaluing or impairing (reducing) the value of an asset, this feature is not likely to be used frequently

The importance of valuation

The net book value of fixed assets shown on the balance sheet of a business indicates to readers

that if necessary the assets could be converted into cash (by selling them) at approximately at that value.

Where the owners of the business are aware that that value is really not correct, either too low or high,

then the assets should be revalued. The amount of the correction accrues to the owners by either reducing or

increasing their interest in the retained profits of the business.

Where the balance sheet is used to support a loan application from a bank or other lender,

then the values of fixed assets would form part of the lenders due diligence process

and it would be better for the figures to appropriate rather then the potential lender discovering a discrepancy.

LATEST NEWS

Bank reconciliation is the process of matching the balances in an entity's accounting records to the corresponding information on a bank statement. The goal is to ascertain that the amounts are consistent and accurate, identifying any discrepancies so that they can be resolved.

Understanding UK payroll is essential for businesses, self-employed individuals, and charities. It involves calculating and distributing wages, deducting taxes and contributions, and complying with HMRC regulations. Proper payroll management ensures timely, accurate employee compensation and adherence to tax and employment rules.

The Gift Aid scheme is well known in the charity sector and provides a welcome 25% boost to donation income. There is no limit to how often you can file your claim with HMRC so, if you have processes in place to be able to claim regularly.

Understanding the intricate details of the Church of England's parochial fees can be daunting. These fees, established by the General Synod and Parliament, cover a wide range of church-related services. Here's a deep dive into what these fees entail and how Liberty Accounts can streamline their accounting process for church treasurers.