Your balance sheet

Understand your assets and liabilities

Unit 10

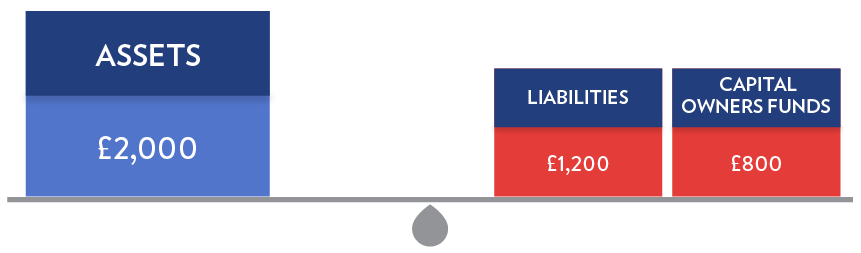

We have already looked at the notion of double entry and that a business transaction will impact two accounts, as the name implies the Balance Sheet reflects that double entry process. The Balance Sheet essentially provides the details of both sides of the Accounting Equation (The Accounting Equation).

The diagram below shows the two sided nature of a balance sheet. Nowadays a balance sheet is usually presented with the liabilities section shown below the assets section not beside it, but for now stick with the side by side style whilst we consider things in a little more detail.

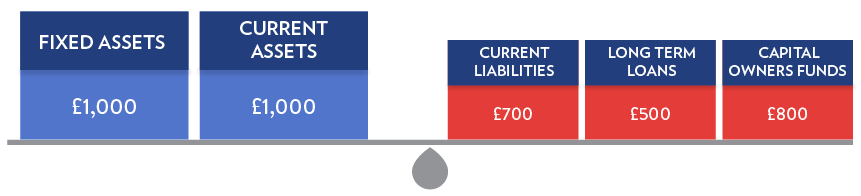

Balance sheets are usually presented in five basic sections and most accounts will appear in one of those sections.

- Fixed Assets – equipment, investments and non physical notions of value such as goodwill held for the longer term

- Current Assets – Stocks, Accounts receivable, Cash (Positive Bank balances) and shorter term assets

- Current Liabilities – Accounts payable, short term loans (overdraft) and shorter term liabilities such as VAT and other tax and national insurance

- Long Term Loans – Loans which are repayable after more than one year such as mortgages, bonds, loans etc.

- Capital – Owners Funds, money put in plus the retained profits from trading (or reduced by losses)

Perhaps not unsurprisingly most enterprises will have a some accounts in each section, but Equipment, Stock, Accounts receivable and payable are particularly common.

The terms above are usual in financial language as too are the following and it is useful to know them:

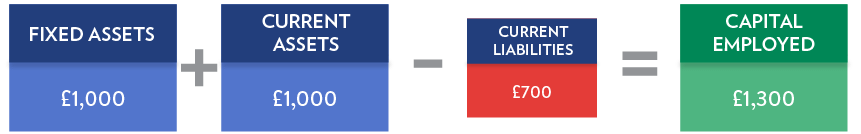

- Capital Employed

- Net Worth

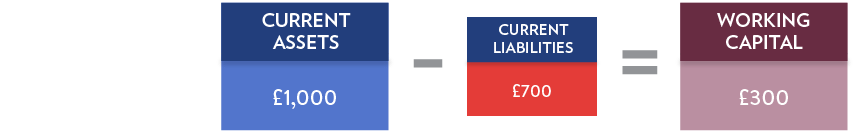

- Working Capital

Capital Employed is a very common term and all it describes is the sum of Fixed Assets + Current Assets – Current Liabilities:

As can be seen from the diagram it also represents the sum of Capital and Long term Loans,

in essence that funds that are being employed in the business for the longer term.

Net Worth is in effect the same as the capital, representing the worth of the business to the owners and long term founders,

so the original funds injected into the business plus the retained profits (or reduced by losses).

The term Working Capital is very common and is used to represent the liquidity of the business or the capacity to release funds in the short term. It is the sum of current assets and current liabilities:

Current assets which are items such as stocks, accounts receivable and cash can be turned into cash relatively quickly. Equally current liabilities such as accounts payable and tax payments can demand cash at short notice; hence a positive working capital is a basic requirement for a business. If working capital is negative (more liabilities than assets) then the business has a potentially serious problem and action must be taken as swiftly as possible to move the working capital to positive. This may mean further injections of funds from the owners or raising long term loans. In both cases the funds will boost the cash and hence the current assets.

LATEST NEWS

Bank reconciliation is the process of matching the balances in an entity's accounting records to the corresponding information on a bank statement. The goal is to ascertain that the amounts are consistent and accurate, identifying any discrepancies so that they can be resolved.

Understanding UK payroll is essential for businesses, self-employed individuals, and charities. It involves calculating and distributing wages, deducting taxes and contributions, and complying with HMRC regulations. Proper payroll management ensures timely, accurate employee compensation and adherence to tax and employment rules.

The Gift Aid scheme is well known in the charity sector and provides a welcome 25% boost to donation income. There is no limit to how often you can file your claim with HMRC so, if you have processes in place to be able to claim regularly.

Understanding the intricate details of the Church of England's parochial fees can be daunting. These fees, established by the General Synod and Parliament, cover a wide range of church-related services. Here's a deep dive into what these fees entail and how Liberty Accounts can streamline their accounting process for church treasurers.