Accounting

The language of business

Unit 1

Often referred to as the language of business; accounting is more a means of keeping score in a common format.

Accounting involves recording business transactions in financial terms and reporting that information to business owners and other interested parties.

Business transactions such as:

- Making a sale

- Buying goods and services

- Paying Staff

- Borrowing money

- Paying loans back

- Investing in assets (machinery, buildings, vehicles etc)

- Paying tax

are described in accounting for the impact that they have and evaluated to a common base known as money.

By common agreement in the UK we accept that the money base is £ sterling (it could be any other unit of measure if we all agreed and recognised it).

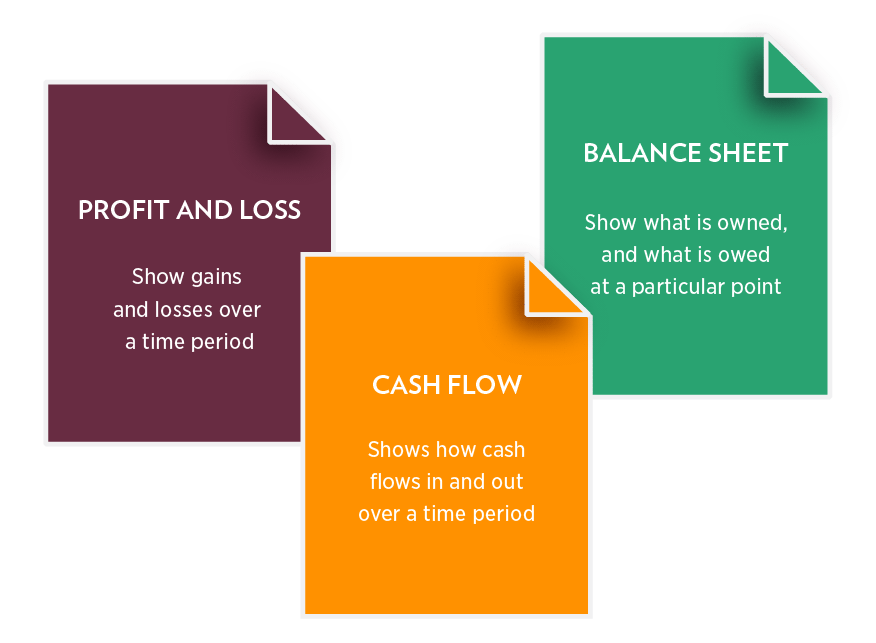

The business score in accounting is usually presented in three documents, each in a particular format and showing financial information of different significance:

Accounts are widely used by many groups and for many reasons; you may be able to add to these lists.

Users of accounts

- Owners / Shareholders – to value their investments

- Managers – assist in control and decision making

- HM Revenue & Customs – agreeing tax liability

- HM Revenue & Customs – agreeing VAT liability

- Central statistical office – official statistics

- Investors – to oversee and/or value their investments

- Banks – to oversee and/or value their investments and loans

- Customers – can I rely on my supplier?

- Suppliers – will I be paid?

- Auditors – the figures to be audited

- General public / Journalists – public interest issues

- Trades Unions – negotiations / industry data

- Employees – information on what is happening to the business they work for?

- Potential employees – safe to work for?

- Pension funds / Fund managers – for potential investment

- Lobby Groups – to review and further their issues

- Authors of books on the subject – for materials and examples

Uses of accounts

- Showing the financial situation of the entity

- Demonstration of compliance to the law

- Reporting performance

- Managing performance

- Valuing an entity

- Demonstrating resources available

- Demonstrating capacity to do things

- Comparisons and benchmarking

- Support for raising finance

- Demonstration of probity

- Supporting tax computations

- Keeping investors (including banks) and potential investors informed

LATEST NEWS

Bank reconciliation is the process of matching the balances in an entity's accounting records to the corresponding information on a bank statement. The goal is to ascertain that the amounts are consistent and accurate, identifying any discrepancies so that they can be resolved.

Understanding UK payroll is essential for businesses, self-employed individuals, and charities. It involves calculating and distributing wages, deducting taxes and contributions, and complying with HMRC regulations. Proper payroll management ensures timely, accurate employee compensation and adherence to tax and employment rules.

The Gift Aid scheme is well known in the charity sector and provides a welcome 25% boost to donation income. There is no limit to how often you can file your claim with HMRC so, if you have processes in place to be able to claim regularly.

Understanding the intricate details of the Church of England's parochial fees can be daunting. These fees, established by the General Synod and Parliament, cover a wide range of church-related services. Here's a deep dive into what these fees entail and how Liberty Accounts can streamline their accounting process for church treasurers.