Accounts receivable

What you are owed

Unit 13

What is an invoice?

Many business offer, or are obliged to offer, credit terms to their customers. Sales invoices are raised and sent to the customer but the expectation is that they will not be paid for a period of time. This period, often known as Terms of Trade, can vary significantly from zero to 180+ days. The value of the amounts remaining unpaid at any time are commonly known as Accounts Receivable or Trade Debtors and the period taken on credit as debtor days or days sales outstanding (DSO).

Accounts receivable values will be found on a balance sheet in the Current Assets section. They are current in that normally the amounts will be received in a relatively short time period.

The management of Accounts Receivable is often critical to managing cash flow and therefore success of the business, so good processes are vital.

It is good practice is to:

- Ensure that Sales Invoices are accurately prepared, addressed and sent to the correct person

- Make sure that Terms of Trade have been agreed and are specified on the Invoice or another document sent to the customer

- Make it easy for your customer to pay you by having a remittance advice attached to the Invoice

- Regularly review your aged debtor analysis

- Actively chase payment when overdue

- Use statement documents to remind customers of the situation

- Above all commit sufficient resources and time to make sure cash from your customers flows in

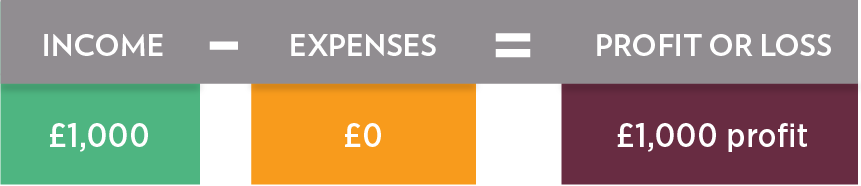

When credit terms are offered to customers than in accounting terms we have created an asset for the funds to be received in the future. For example the equations for a £1000 sales invoice on credit would be:

When eventually the invoice is paid by the customer the asset type would move from being an amount receivable to an amount in the bank account but still an asset.

Is it still receivable?

These days unfortunately it is all too common for a customer who was thought to be capable of paying what they owe now not being able to.

If nothing is done then the amount they owe will sit on the balance sheet as an asset that in reality does not exist.

It is good practice to regularly review the accounts receivable with a realistic eye and write-off, as a bad debt,

any amounts that will not be received.

Most good accounting packages will provide users with reports to help manage the accounts receivable, with reports showing outstanding amounts, the ability to send statements to customers and an analysis of how old (in terms of average days unpaid) outstanding invoices are. This is known as an aged debtors report.

Sales Invoices

Prepare sales invoices as accurately as possible to avoid any arguments that will delay your customer from paying on the agreed date.

If the business is VAT registered then sales invoices must be in compliant form with compliant information including the VAT Registration Number.

Consult a professional advisor if necessary.

LATEST NEWS

Bank reconciliation is the process of matching the balances in an entity's accounting records to the corresponding information on a bank statement. The goal is to ascertain that the amounts are consistent and accurate, identifying any discrepancies so that they can be resolved.

Understanding UK payroll is essential for businesses, self-employed individuals, and charities. It involves calculating and distributing wages, deducting taxes and contributions, and complying with HMRC regulations. Proper payroll management ensures timely, accurate employee compensation and adherence to tax and employment rules.

The Gift Aid scheme is well known in the charity sector and provides a welcome 25% boost to donation income. There is no limit to how often you can file your claim with HMRC so, if you have processes in place to be able to claim regularly.

Understanding the intricate details of the Church of England's parochial fees can be daunting. These fees, established by the General Synod and Parliament, cover a wide range of church-related services. Here's a deep dive into what these fees entail and how Liberty Accounts can streamline their accounting process for church treasurers.